Shares nudge higher in Asia, oil slips on truce talks

thestar.com.my -- Sunday, August 17, 2025, 9:22:13 PM Eastern Daylight Time

Categories: U.S.–Russia Relations, Economic Policy & Jobs

SYDNEY: Share markets edged higher in Asia on Monday ahead of what is likely to be an eventful week for U.S. interest rate policy, while oil prices slipped as risks to Russian supplies seemed to fade a little.

U.S. President Donald Trump now seemed more aligned with Moscow on seeking a peace deal with Ukraine instead of a ceasefire first, after meeting Russian President Vladimir Putin in Alaska on Friday.

Trump will meet Ukrainian President Volodymyr Zelenskiy and European leaders later on Monday to discuss the next steps, though actual proposals are vague as yet.

The major economic event of the week will be the Kansas City Federal Reserve's August 21-23 Jackson Hole symposium, where Chair Jerome Powell is due to speak on the economic outlook and the central bank's policy framework.

"Chair Powell will likely signal that risks to the employment and inflation mandates are coming into balance, setting up the Fed to resume returning policy rate to neutral," said Andrew Hollenhorst, chief economist at Citi Research.

"But Powell will stop short of explicitly signalling a September rate cut, awaiting the August jobs and inflation reports," he added. "This would be fairly neutral for markets already fully pricing a September cut."

Markets imply around an 85% chance of a quarter-point rate cut at the Fed's meeting on September 17, and are priced for a further easing by December.

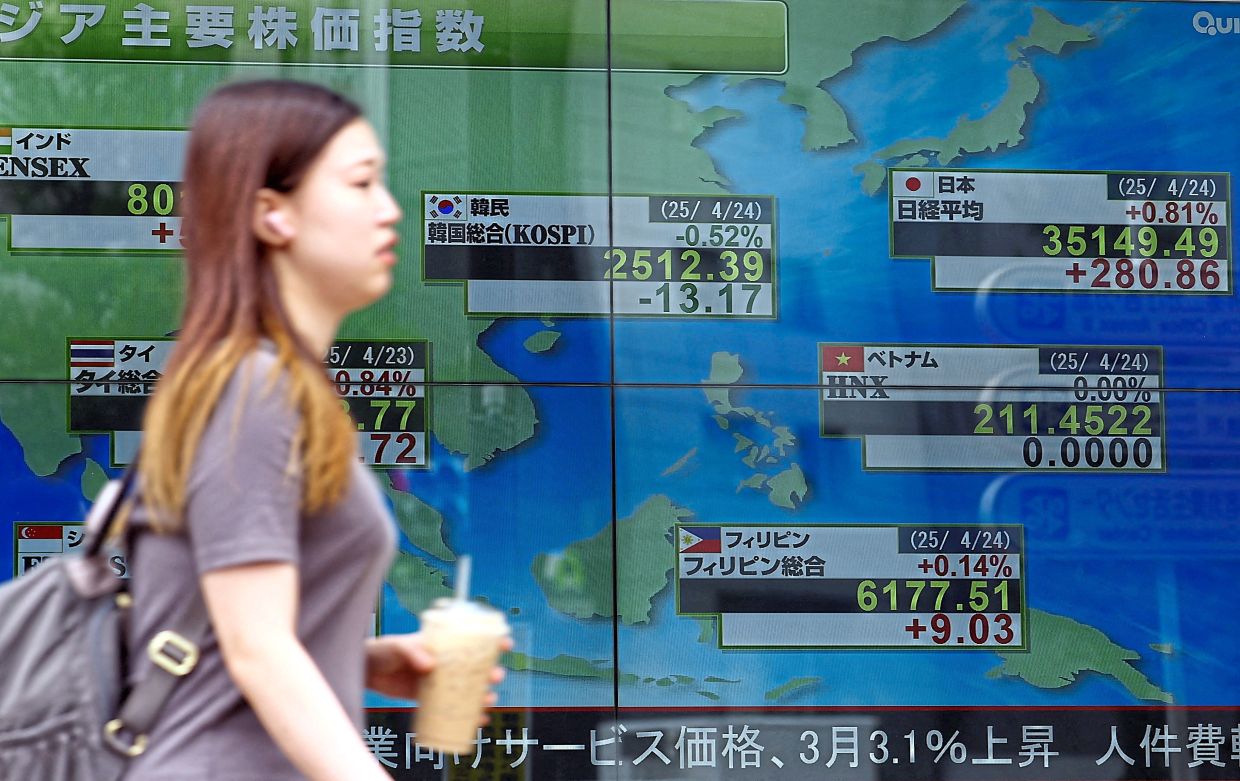

The prospect of lower borrowing costs globally have underpinned stock markets and Japan's Nikkei firmed 0.5% to a fresh record high.

MSCI's broadest index of Asia-Pacific shares outside Japan was a fraction lower, having hit a four-year top last week.

EUROSTOXX 50 futures rose 0.3%, while FTSE futures and DAX futures gained 0.2%.

SOLID EARNINGS

S&P 500 futures nudged up 0.1%, while Nasdaq futures added 0.2% with both near all-time highs.

Valuations have been underpinned by a solid earnings season as S&P 500 EPS grew 11% on the year and 58% of companies raised their full-year guidance.

"Earnings results have continued to be exceptional for the mega-cap tech companies," noted analysts at Goldman Sachs. "While Nvidia has yet to report, the Magnificent 7 apparently grew EPS by 26% year/year in 2Q, a 12% beat relative to consensus expectation coming into earnings season."

This week's results will provide some colour on the health of consumer spending with Home Depot, Target, Lowe's and Walmart all reporting.

In bond markets, the chance of Fed easing is keeping down short term Treasury yields while the longer end is pressured by the risk of stagflation and giant budget deficits, leading to the steepest yield curve since 2021.

European bonds also have been pressured by the prospect of increased borrowing to fund defence spending, pushing German long-term yields to 14-year highs.

Wagers on more Fed easing has weighed on the dollar, which dropped 0.4% against a basket of currencies last week to last stand at 97.851.

The dollar was a fraction firmer on the yen at 147.33 , while the euro held at $1.1704 after adding 0.5% last week.

The dollar has fared better against its New Zealand counterpart as the country's central bank is widely expected to cut rates to 3.0% on Wednesday.

In commodity markets, gold was stuck at $3,328 an ounce after losing 1.9% last week.

Oil prices struggled as Trump backed away from threats to place more restrictions on Russian oil exports.

Brent dropped 0.4% to $65.61 a barrel, while U.S. crude eased 0.2% to $62.67 per barrel. - Reuters

Sign Our PetitionThe recent movements in global financial markets, particularly in Asia, reveal a complex intersection of economic policy, geopolitical dynamics, and historical context that merits closer examination. As markets respond to anticipated shifts in U.S. interest rate policy and geopolitical developments surrounding Russia and Ukraine, it is crucial to understand how these factors are interconnected and what they mean for everyday people. This commentary will explore the implications of these events in light of ongoing social struggles, historical injustices, and the broader economic landscape.

First, the anticipated Federal Reserve meeting at Jackson Hole signifies more than just a routine economic forecast. It is a reflection of the Fed's critical role in shaping the economy in ways that impact workers, families, and marginalized communities. Historically, monetary policy has not been neutral; it often exacerbates existing inequalities. For instance, while interest rate cuts can stimulate borrowing and investment, they also disproportionately benefit wealthier individuals and corporations who have easier access to capital. This dynamic has been evident since the 2008 financial crisis when aggressive monetary easing policies led to a stock market recovery that left behind lower-income Americans. As the Fed considers its next steps, the potential for a quarter-point rate cut may come with a renewed call to address the systemic inequities that capitalism perpetuates.

Moreover, the shifting narrative in U.S.-Russia relations, particularly President Trump's alignment with Moscow regarding Ukraine, is deeply concerning. Historical context reveals that U.S. foreign policy has often prioritized geopolitical interests over the welfare of the people in affected regions. The ongoing conflict in Ukraine is not merely a political chess game; it has dire consequences for those living on the frontlines. As the U.S. and its allies engage in discussions about peace and ceasefire, it is essential to emphasize the importance of centering the voices of Ukrainians and ensuring that their rights and sovereignty are not compromised for the sake of political expediency. The lessons of past interventions, where the U.S. has supported regimes that perpetuated violence and oppression, must inform a more compassionate and just approach to foreign policy.

The current economic landscape, characterized by rising stock prices and strong earnings reports from tech giants, presents a stark contrast to the lived experiences of many working-class individuals. While the S&P 500's robust performance may suggest a flourishing economy, it masks the reality of stagnating wages, rising costs of living, and an increasingly precarious job market for many. Companies like Home Depot and Walmart may report solid sales, but these figures do not capture the struggles of workers who face low wages and inadequate benefits. As we analyze these economic indicators, it is critical to connect them to the broader narrative of economic justice, advocating for policies that prioritize workers’ rights, living wages, and equitable growth rather than mere profit maximization.

Additionally, the looming threat of stagflation and rising budget deficits raises important questions about government spending priorities. The prospect of increased military spending to address European security concerns, particularly in light of the situation in Ukraine, underscores a long-standing pattern of prioritizing military expenditures over social and infrastructural investments. Historically, such choices have reflected a broader ideological commitment to militarism rather than social welfare. As communities grapple with issues such as healthcare access, education, and affordable housing, advocates must challenge policymakers to redirect funds toward initiatives that enhance social well-being rather than perpetuating cycles of violence and oppression.

Finally, the discussion about the dollar's decline and the potential for a more multilateral global economy opens space for reimagining economic relationships. The dominance of the dollar has historically reinforced U.S. hegemony, often at the expense of developing nations. However, as countries explore alternatives, there is an opportunity for more equitable economic partnerships that prioritize sustainable development and social equity. Engaging in conversations about the future of global finance, trade, and investment can empower communities to advocate for economic systems that uplift all people rather than serving elite interests.

In conclusion, the interplay of economic policy, geopolitical dynamics, and historical context demands a nuanced understanding of current events. By connecting these threads to ongoing social struggles, advocates can articulate a vision for a more just and equitable society. It is essential to engage in these conversations, challenging the status quo and prioritizing the needs of those most affected by these policies. Ultimately, fostering a more inclusive and compassionate economic and political landscape will require diligent advocacy and a commitment to social justice in all its forms.

The recent article highlights several interconnected economic and geopolitical dynamics that are shaping the global landscape, particularly in relation to U.S. monetary policy and international relations. As we analyze these developments, it is critical to recognize the broader implications for social justice, economic equity, and the environment, which are often overshadowed by discussions focused solely on market performance or interest rates. The intertwining of U.S. financial policy and its foreign engagements, particularly with Russia and Ukraine, demonstrates a complex web that demands a critical and informed response from the American public.

Historically, the U.S. has wielded significant influence in global economic affairs, frequently prioritizing its own interests over the welfare of other nations. This has manifested in various forms, from military interventions to economic sanctions. As President Trump aligns more closely with Moscow in pursuit of a peace deal in Ukraine, we must interrogate the motivations behind such stances. Does this represent a genuine desire for peace, or is it a strategic maneuver to bolster domestic approval ratings? Regardless of the answer, it is evident that international diplomacy often becomes a bargaining chip in domestic political games, undermining the possibility for genuine resolution and stability in regions like Ukraine that have suffered immensely.

The anticipated discussions at the Jackson Hole symposium regarding U.S. interest rates are another critical element of this narrative. While lower borrowing costs may seem beneficial for markets, we must consider who truly benefits from such policies. As inflation continues to rise and economic disparities widen, the focus should shift towards creating a more equitable economy that prioritizes workers and families over corporate profits. The recent earnings reports from major corporations, particularly in the tech sector, highlight an economy that is increasingly skewed toward the wealthy. As they reap record profits, millions of Americans continue to struggle with wage stagnation and inadequate access to essential services. This stark contrast calls for a comprehensive reevaluation of our economic policies and priorities.

As citizens, we have the power to advocate for systemic change that addresses these inequities. Grassroots movements can play a pivotal role in shaping public discourse and influencing policy decisions. Engaging in local and national discussions about economic justice, advocating for living wages, and demanding accountability from elected officials can create a groundswell of support for policies that promote equity. Whether through organizing protests, supporting inclusive candidates, or simply educating ourselves and others about the implications of these economic policies, we can contribute to a shift that prioritizes the needs of the many over the interests of the few.

Moreover, the environmental dimension of economic policy cannot be overlooked. As discussions of increased defense spending arise—prompted by geopolitical tensions—there is a risk that urgent issues like climate change will be relegated to the background. Increased military spending could detract from investment in sustainable energy, public transport, and other green initiatives that are necessary for a healthier planet. We must advocate for an economic framework that recognizes the interdependency of social, economic, and environmental health. This requires not just a reallocation of resources but also a fundamental transformation in how we view the relationship between the economy and the environment.

In conclusion, the current economic and geopolitical landscape presents both challenges and opportunities for progressive action. By critically engaging with the dynamics at play—be it U.S. monetary policy, international relations, or corporate earnings—we can advocate for a more just and equitable society. This involves not only pushing for policies that support workers and families but also ensuring that our approach to global diplomacy reflects our commitment to peace and justice. As we navigate this complex terrain, it is imperative that we remain vigilant, informed, and active in championing a vision of an economy that serves all, rather than just a privileged few.

In light of the developments presented in the article, there are several actions that concerned individuals can take to engage constructively with the political and economic landscape. Below is a detailed list of personal actions, real-world examples of petitions, and specific contacts to consider.

### What Can We Personally Do About This?

1. **Advocate for Transparent Economic Policies:** - Engage in discussions about the implications of interest rate changes on everyday Americans, particularly the working class. - Push for policies that prioritize job stability and wage growth.

2. **Support Peace Initiatives:** - Advocate for diplomatic solutions in conflicts, particularly regarding Ukraine and Russia. - Promote grassroots peace organizations that work towards conflict resolution.

3. **Engage with Local Economies:** - Support local businesses and initiatives that foster community resilience in the face of global economic fluctuations.

4. **Participate in Public Discourse:** - Write articles or blogs that highlight the impact of economic policies on social equity and worker rights. - Join forums or community discussions on economic justice.

### Exact Actions You Can Take

1. **Sign Petitions:** - **Petition for Peace in Ukraine:** Look for petitions on platforms like Change.org advocating for peace talks and humanitarian aid. - Example: [Change.org Petition for Ukraine Peace Talks](https://www.change.org) (search for relevant petitions). 2. **Contact Local Representatives:** - **Who to Write:** - Your local Congressional Representative or Senator. - For example, if you live in California, you might contact: - **Representative Nancy Pelosi** - Email: pelosi.house.gov/contact - Address: 450 Golden Gate Avenue, 14th Floor, San Francisco, CA 94102 - **Senator Alex Padilla** - Email: padilla.senate.gov/contact - Address: 112 Hart Senate Office Building, Washington, DC 20510

3. **Write to the Federal Reserve:** - **Who to Write:** - Chair Jerome Powell - Email: Use the contact form at the Federal Reserve website: federalreserve.gov. - Address: 20th Street and Constitution Avenue NW, Washington, DC 20551 - **What to Say:** - Express concerns about how interest rate policies impact everyday Americans, especially regarding housing affordability and job security. Request that the Fed prioritize employment and wage growth in their decision-making.

4. **Engage with Local Community Organizations:** - Join or support organizations that focus on economic justice, such as: - **The Economic Policy Institute**: Advocacy for fair wages and labor rights. - **Local grassroots organizations**: Many cities have groups focused on economic justice and community support.

5. **Raise Awareness on Social Media:** - Share information about the impact of economic policies on social equity and advocate for peace. - Use hashtags related to economic justice, peace initiatives, and community support.

6. **Attend Town Hall Meetings:** - Participate in local government or town hall meetings to discuss economic policies and their local impacts. - Prepare questions and points regarding the need for transparent economic strategies that support all citizens.

### Conclusion

Engagement in these areas not only amplifies the voice of those advocating for equitable economic policies but also fosters a collective movement toward creating a more just society. By actively participating in the democratic process, whether through communication with representatives, signing petitions, or supporting local initiatives, individuals can contribute to meaningful change in their communities and beyond.